Global Supply Chains at Full Throttle: GEP Index May 2024

The latest GEP Global Supply Chain Volatility Index shows global supply chains are running close to their maximum capacity, suggesting a stable forecast.

GEP's index is a trusted resource for procurement, purchasing and supply chain professionals worldwide. Drawing insights from a monthly survey of 27,000 businesses, it offers a comprehensive view of prevailing market conditions, covering shortages, transportation costs, inventories and backlogs.

According to the latest data published in May, global supply chains are experiencing an upturn in activity. After grappling with supply shocks, inflation and uncertainty for four years, they're now operating at near-maximum capacity, suggesting a stable outlook.

"Following four years of supply shocks, inflation, stockpiling and uncertainty, global supply chains are now operating within a Goldilocks zone, characterised by a stable state of full capacity," comments Mike Seitz, Vice President at GEP Consulting. "This development is excellent news for global suppliers and businesses."

"In China, we're witnessing a gradual uptick in manufacturing activity, prompting Chinese Premier Li Qiang to expedite efforts aimed at eliminating barriers imposed by European markets and fostering increased FDI. This initiative gains significance amidst the looming prospect of tougher US tariffs and trade policies."

Key insights from GEP index

- Asia on the move: Asian factories are ramping up input purchases to meet escalating orders, coinciding with diplomatic efforts to dismantle trade barriers in Europe.

- Challenges in North America: Manufacturers are facing hurdles in fulfilling orders due to staff shortages and material scarcities.

- Transportation costs: Global transportation costs have seen a slight uptick following recent spikes in oil prices.

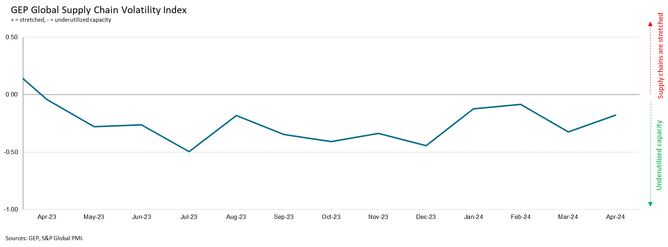

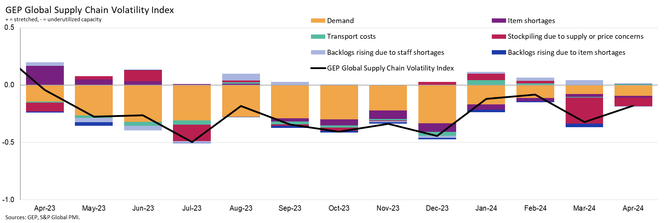

In April, the GEP Global Supply Chain Volatility Index rose to -0.18 from -0.32 in March, indicating global supply chains are nearing full capacity.

This increase in activity is attributed to improved demand patterns, especially in Asia, where procurement managers reported increased purchasing activity.

However, North America faces tightening capacity, with reports of backlog accumulation, while Europe's demand conditions remain less robust despite easing industrial downturn.

Key Findings in April's GEP Global Supply Chain Volatility Index

DEMAND: Global demand for raw materials, commodities and components remained close to its long-term average in April, indicating significant improvement compared to late last year. Asia emerged as a key driver of positive growth, with major manufacturing nations such as China, India and South Korea reporting expansions.

INVENTORIES: Inventory drawdowns continued into April, albeit at a slower pace compared to March. Instances of inventory build-ups due to price or supply concerns were at their lowest levels in more than four years.

MATERIAL SHORTAGES: Reports of material shortages, including semiconductors, foodstuff, chemicals and metals, remain historically low.

LABOUR SHORTAGES: After rising for three consecutive months, reports of backlog accumulation due to staff shortages declined in April, aligning closely with historical norms. Notably, North America experienced more pronounced labour shortages compared to other regions.

TRANSPORTATION: Following recent increases in oil prices, global transportation costs experienced their first uptick of the year in April.

Regional variations in the GEP Global Supply Chain Volatility Index

NORTH AMERICA: The index remained largely unchanged at -0.30, indicating spare capacity, although input demand trends showed improvement in April, alongside increased backlog accumulation.

EUROPE: The index declined to -0.55 from -0.62, suggesting a continued easing of the continent's industrial downturn.

U.K.: The index decreased to -0.47 from -0.17, reflecting sharp destocking among UK manufacturers instead of ordering from suppliers.

ASIA: The index rose to 0.07 from -0.07, marking the first month of stretched supplier capacity since January.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is published monthly and is a collaborative effort between S&P Global and GEP, drawing from S&P Global's PMI surveys distributed to 27,000 companies worldwide.

The main index is calculated as a weighted aggregation of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price and Supply Indicators provided by S&P Global.

A positive value indicates strained supply chain capacity, leading to increased volatility. The higher the value, the greater the strain on capacity.

Conversely, a negative value suggests underutilised supply chain capacity, resulting in reduced volatility. The lower the value, the greater the degree of underutilisation of capacity.

******

Make sure you check out the latest edition of Supply Chain Digital and also sign up to our global conference series - Procurement & Supply Chain 2024

******

Supply Chain Digital is a BizClik brand

- Procurement & Supply Chain LIVE New York 2024: Day Two RecapDigital Supply Chain

- Submissions Closed: Global Procurement & Supply Chain AwardsDigital Supply Chain

- Sustainability Shines Through on P&SC LIVE New York Day OneSustainability

- Celebrating International Supply Chain Professionals DayOperations