Facing headwinds and high expectations for global commerce

Today, exchange rates are experiencing volatility, with economic headwinds leading to unpredictable impacts on a growing global trade market post-COVID-19. This volatility is affecting cross-border trade for SMEs and large corporations alike.

Interest rates from 155 central banks between August 2021-2023 have risen over 500 times – constituting the most aggressive period of interest rate hikes ever recorded – a reality that has jolted foreign exchange (FX) rates.

The cause of these unprecedented hikes? The need to swiftly contain inflation. Central banks have had to reverse course from their actions during the COVID-19 pandemic when over 200 interest rate cuts happened throughout 2020.

As the gears of industry and trade began turning again in 2021, a regime shift has been mandated to control inflation. But rapidly imposed, successive interest rate hikes have knocked exchange rates; the euro, US dollar and pound sterling have seen much volatility since.

In fact, Kybira’s 2023 Currency Impact Report examining 1,200 companies found that rising exchange rate risk cost them US$64.2bn in Q3 2022 alone. These FX headwinds were more than three times the fiscal amount of any tailwinds experienced by any of the sampled companies.

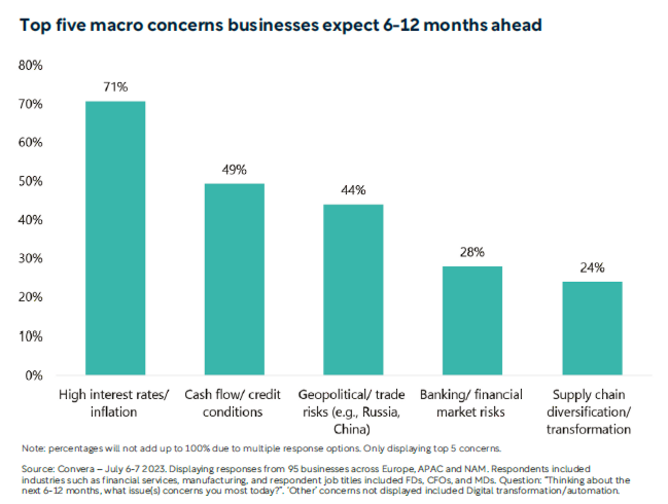

Moreover, a Convera survey found that 71% of such businesses counted high inflation and rising interest rates as the most pressing macroeconomic issues they face, with another 49% citing a lack of cash flow and 44% geopolitical trade risks as the most immediate issues. These figures are best highlighted in the graph below.

With these figures in mind, it’s clear that exchange rate risk constitutes a significant point of friction in cross-border trade for SMEs and corporates alike. These headwinds are affecting payments and organisations’ bottom lines.

2024 may mark a turning point, with volatility easing at the back end of the year to keep cross-border trade on a path to growth. Convera forecasts that cross-border business will accelerate some 33% between 2023-2028, reaching US$39.8tn from US$30.3tn in 2022.

Today’s higher for longer interest rate narrative will be challenged if inflation falls to the much-coveted 2% mark, meaning central banks could be compelled to lower interest rates.

In the US, inflation is already falling, but economic resilience has resulted in volatile US exchange rate expectations, reducing the US dollar’s 13% fall from its October 2022 high, to around 7% at present.

While falling inflation could constitute a shift in monetary policy from central banks – which in turn could impact FX rates – other factors could contribute to the broader macroeconomic outlook and the potential for further FX rate volatility: bond and equity price divergence, credit conditions, trade circumstances, and the geopolitical landscape.

This report considers each of these coalescing factors, forecasting their compounding effects on FX rates.

From Convera’s perspective, the key to success for cross-border trading businesses in 2024 will be determined by their ability to mitigate cross-border frictions and volatility, negate losses and maximise growth. Those who succeed will execute sophisticated hedging processes, effectively automating these processes at speed.

Having the right solutions in place will enable global organisations to address cross-border frictions, ensuring they remain beneficiaries of a growing trade industry, amid widening macroeconomic uncertainty.

Today’s macroeconomic landscape: A picture of economic uncertainty

Exchange rates are experiencing volatility today. This is a legacy of recent crises – from the US-China trade war, the aftermath of fiscal COVID-19 measures and Russia’s war with Ukraine – all leading to the current cost-of-living crisis stretching from 2021 into 2023.

Many economists predicted the global economy would fall under its weight, with high interest rates and high energy prices – the latter a partial symptom of severed trade with Russia following its invasion of Ukraine – seeing consumers’ wallets pinched and the economy heading to a potential recession.

Despite fears, inflation – particularly in the US (as aforementioned) – has started to fall. With incoming economic data showing resilience, these stagflation risks have subsequently eased.

But where does this economic resilience come from? The pandemic may have had a part to play. Fiscal stimulus measures sparked a global consumption boom that is still influencing the global economy in 2023.

Consumers have accrued excess savings post-pandemic and a shift in consumer preferences may have contributed to the disconnect between lagging and leading economic indicators currently seen.

But this is not the only disparity contributing to an uncertain economy. The potential for further divergence between bond and equity markets could further alter the outlook for FX rates.

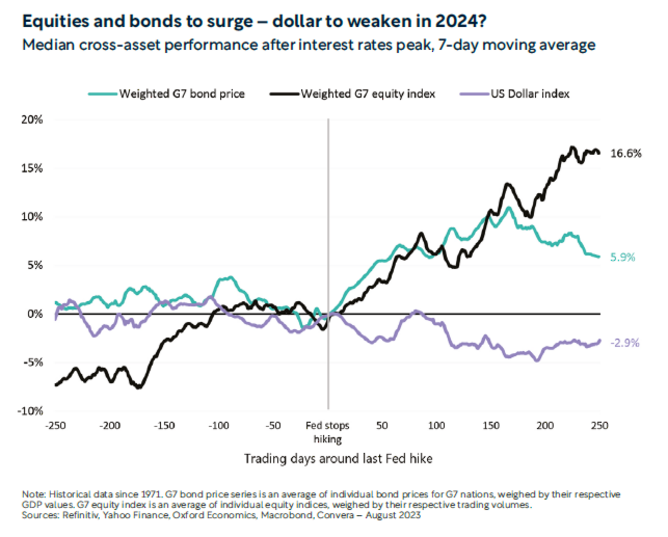

Quantitative tightening is gaining more and more attention and could have significant side effects for the economy and, subsequently, FX rates. Bond yields have continued to surge as central banks raise interest rates across the board and actively sell government bonds. The graph below shows how, historically, bond prices fall when the Federal Reserve raises rates, but rise once rates eventually reach their peak.

Additionally, equities have surprisingly outperformed this year and the VIX Index - a measure of equity market volatility commonly known as the “fear index” - has stayed below its long-term index average of 20 for over three quarters of this year. In comparison, we saw the VIX Index above 20 for over 90% of the time in 2022.

This only adds to the picture of an uncertain economy, and the divergence between bond and equity markets could lead to further jolts in FX volatility as we head into 2024.

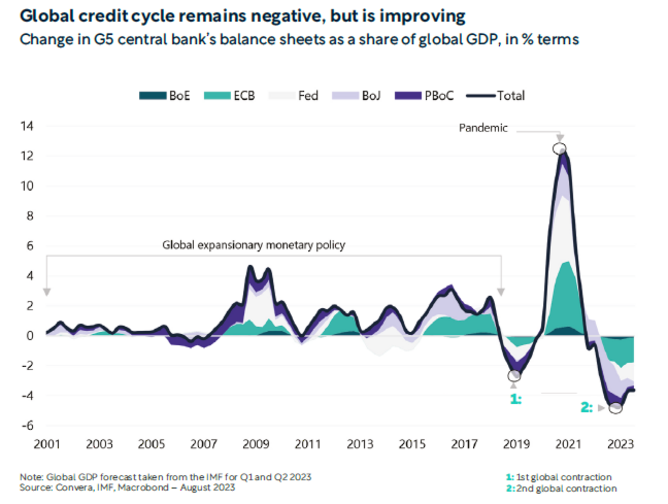

Quantitative tightening to reduce the economy's money supply, as imposed by central banks, has been mirrored in the credit space. In fact, one of the most aggressive credit tightening cycles is potentially coming to an end, although the impact of higher credit rates is still feeding through.

The result of this tightening is that 40% of consumers across 28 markets expect their disposable income to fall in the next year, potentially driving down consumer spending.

For years, consumers have relied upon cheap credit. In December 2020, at the height of the pandemic, the world’s negative-yielding debt pile hit a record high of US$18tn and home prices in the US, UK and Germany rose by an average of 30% from the start of 2020 to mid-2022.

But since then, the battle against rising inflation has shifted the landscape of credit in the private sector. Today, short-term interest rates and mortgage rates in G10 countries have hit a 14-year high, and we see companies and households having to adjust to a new rate environment.

While we don’t expect credit conditions to tighten much more, the lagged negative effect of tighter conditions is yet to be experienced by businesses and households.

This could be particularly true for mortgage holders. In the UK, mortgage debt has shifted from being responsive to changing interest rates to stagnant over longer periods as many consumers have elected for fixed mortgage rates in blocks of two or five years.

With this lagged impact on consumers in mind, financial conditions – particularly consumer spending – could tighten further in 2024 when both sovereign credit and mortgages come due for refinancing.

We are already seeing tighter bank lending standards due to rising interest rates, which may start to crimp down on credit flowing to businesses and households, particularly those households with mortgages due for refinancing.

In the Eurozone, the Bank Lending Survey (BLS) reported demand from firms for loans or drawing of credit lines in the second quarter of 2023 dropped to a record low.

Meanwhile, the share of small US firms reporting it is difficult to access loans rose to a 10-year high in May 2023, and the Senior Loan Officer Opinion Survey (SLOOS) showed that US banks’ tighter lending standards have breached the threshold that in the past was consistent with a recession. This may come into sharper focus once lag effects have run their course.

And yet – to add further fuel to economic uncertainty – while credit may be tightening and bond prices surging, global stocks have bucked the trend seen from other economic indicators that point toward recession – appreciating over 15% year-to-date. US Nasdaq stocks are particularly noteworthy in their defiance of expectations, surging 40% in large part thanks to the emergence of AI products on the market.

With global stocks healthy, one may assume this lays the foundation for stability in global trade. But is this the case? Yes and no. While the value of cross-border global trade, much like stock markets, defied expectations of a downturn – growing 24% between 2019 and 2022 – a thriving global cross-border trade market does not necessarily rule out volatility, particularly regarding FX rates.

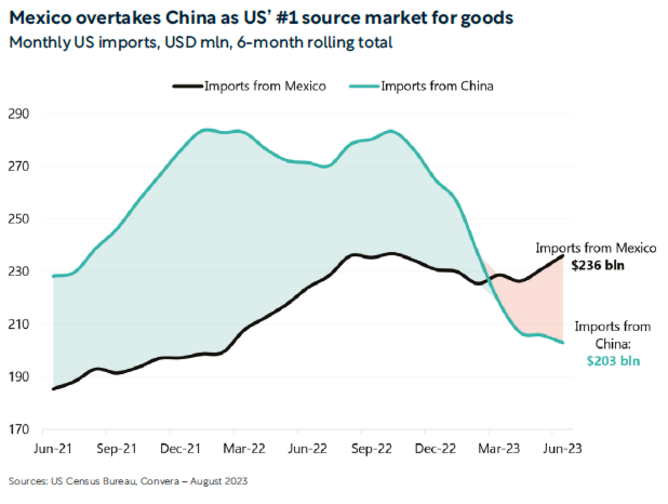

New politically charged trading policies have had a big impact on trade in recent years, as leading Western nations look to diversify from an over-reliance on China. Near-shoring trading has seen India, Vietnam, Mexico and Thailand become key beneficiaries of new trade opportunities as global firms move production away from China.

The US Inflation Reduction Act and the CHIPS and Science Act have both impacted the ability of China to undertake trade with the US and accept foreign direct investment. Chipmaker Intel is one major producer that is considering moving production out of China to comply with new US regulations.

Today, the difference between Chinese imports into the US compared to five years ago is stark. In the first six months of 2018, Chinese imports into the US sat at US$249bn, but in the same period in 2023, Chinese imports accounted for only US$203bn – a drop of 18.5%.

Decoupling from China, the US has turned to Mexico as its number one importer. Its imports have grown from US$168bn in the first six months of 2018 to US$236bn in the first six months of 2023 – an increase of more than 40%, underpinning the geopolitically-fuelled shifts emerging in trade patterns post-pandemic as part of the US-China trade war.

The process of decoupling from China is hastening amid growing geopolitical tensions, something that is bound to have implications for USD/CNY exchange rates.

This could be further complicated, as Xi Jinping looks to diversify his country’s economy, a process that is expected to result in China generating more than one-quarter of all global consumption growth - more than any other country.

How the Chinese Yuan will subsequently look against the US Dollar seems all the more uncertain.

Shifting trade conditions are not endemic to just China and the US, Europe has introduced the EU Carbon Border Adjustment Mechanism (coming into force in 2026) to penalise high-carbon imports which, according to Energy Monitor, is likely to have the biggest impact on Russia. Over US$10bn of its largely iron and steel exports between 2015 and 2019 would have fallen under this new CBAM legislation.

Of course, the key driver in these shifting trade conditions is the result of geopolitical decisions and the key role politics plays in economic issues that affect FX rates. And in 2024, some big political events could alter economic outlooks, thus fuelling exchange rate volatility.

No upcoming political event is perhaps as large as the impending 2024 US election, where it is expected that incumbent President Joe Biden will again face off with Donald Trump, the likely Republican candidate.

The outcome of this election could have vastly different geopolitical implications. For instance, would another Trump administration roll back any of the severe economic sanctions on Moscow that ensued after Russia invaded Ukraine in 2022?

Such is the polarity in today’s political sphere that the impact of elections on the economy is arguably more unpredictable than ever.

History backs this up. Since 1980, only six of the US’s Congressional 21 sessions (29%) have been led by a unified government, leading to higher policy uncertainty.

Add to that Donald Trump’s 2016 election win, the US-China trade war and pandemic-led economic policy responses, and the polarity only grows. The Global Economic Policy Uncertainty Index has already reached record levels near 435 in 2020 (versus 196 in 2010) and it has never really normalised to pre-pandemic levels.

Such political conditions are not constrained to the US alone either – they are global.

Take the UK, where the British pound collapsed in 2022 because of then-Prime Minister Liz Truss’ poorly received economic recovery plan. And the UK could see further economic shifts in 2025 at the time of its next general election.

That is if it does happen in 2025. There are suggestions current Prime Minister Rishi Sunak could pull this timeline forward should the UK economy remain on a resilient path. And should the British public vote in the Labour Party after more than a decade out, there is a chance this could alter UK-EU trade and business relations.

The scope for election-driven economic uncertainty is everywhere in 2024, with key elections happening in Mexico, South Africa and the EU. There is uncertainty around the election of a new European Parliament in 2024, with far-right candidates gaining traction in recent months.

Could far-right candidates, if successful, reshape the European landscape for climate policy and lead to a more conservative Brussels?

This adds to today’s economic picture of disparity and uncertainty. The changeability of political policy and shifting trade allegiances, alongside a lag in the pinch on credit, and a divergence between bonds and equities points to an uncertain economic outlook, one which could unpredictably affect FX rates globally.

Most forward-looking indicators – like the Purchasing Managers Index, the Conference Board’s Economic Index, and yield curves across government bonds – point to high recession probabilities in 2024, while backward-looking indicators continue to perform well.

The last four recessions have been preceded by circumstances that are currently in place, such as tighter US Federal Reserve monetary policy, the New York Federal Reserve’s recession probability indicator rising above 30%, the Conference Board’s US Leading Economic Index falling below -5, over 50% of US bond yield curves inverting, and the US’ CEO Confidence Index falling below the key 40 threshold. Nevertheless, consumer spending has remained resilient and global stocks have appreciated, with the Nasdaq surging.

So, amid the divergence and uncertainty today, what outcomes should we expect in 2024, and how could these potential outcomes affect FX rates?

Get a copy of our full report: Are you ready for 2024?

In our full report, we’ll provide an even more comprehensive outlook for 2024, looking at how key markets will be affected in our FX rates analysis and forecast scenarios and recommendations for crossborder businesses looking to successfully navigate international trade as we enter 2024. Register here to receive a copy of our full report, launching at Money2020 US on October 23rd.